Start Your Expedition

PCAF in the overall ESG context

The "European Green Deal" has significantly influenced the sustainable ESG transformation in the financial industry in recent years. This is a trend that will continue and intensify in the future.

In addition to regulatory requirements, more and more interest groups are emerging that have the potential and the ambition to develop industry standards. For example, this is evident in the accounting for CO2 emissions attributable to the respective product portfolio.

The Partnership for Carbon Accounting Financials (PCAF) was founded in 2015 in the Netherlands and now includes over 440 participating institutions worldwide, including banks, insurance companies, and asset managers (as of October 2023).

With the help of a globally standardized procedure, the participating institutions aim to make their respective contributions (attribution factors) to the CO2 emissions of their clients comparable and manageable.

From this, individual or collective measures can be derived and implemented to reduce CO2 emissions overall, thus contributing to achieving climate neutrality by 2050 (cf. European Green Deal, Paris Climate Agreement). PCAF pursues the vision of establishing the PCAF standard for accounting for CO2 emissions as a "common practice" worldwide.

The European Green Deal has significantly shaped the ESG transformation in the financial sector. Through initiatives like the Partnership for Carbon Accounting Financials (PCAF), we help companies accurately account for CO2 emissions and take effective measures to achieve climate goals.

Our Approach

Relevance of PCAF and individual approach

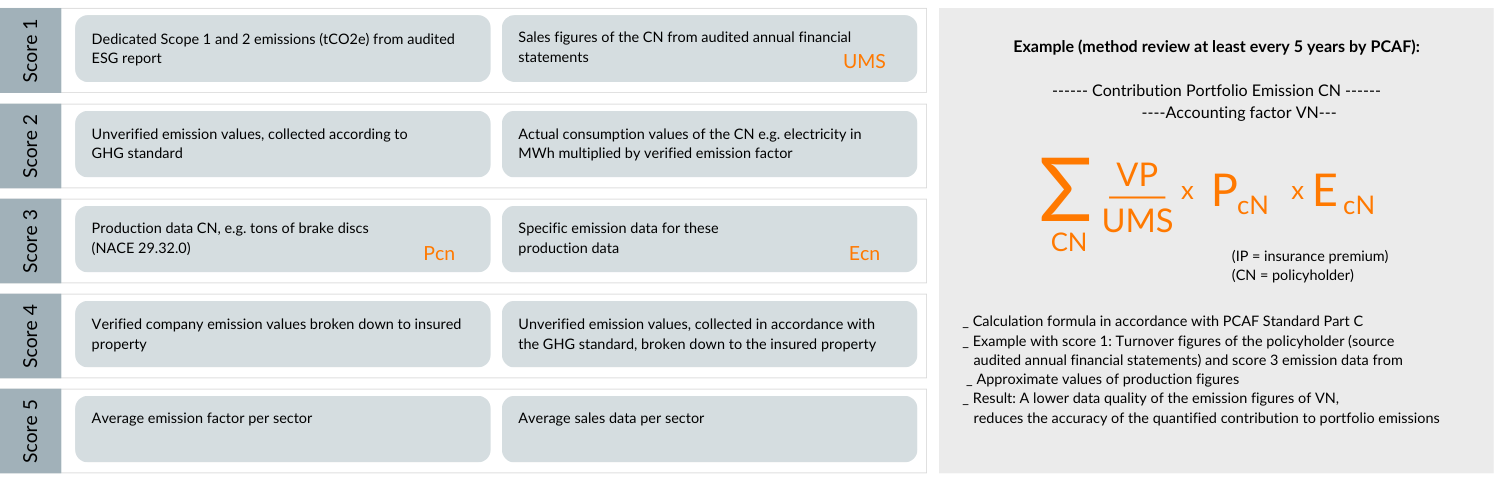

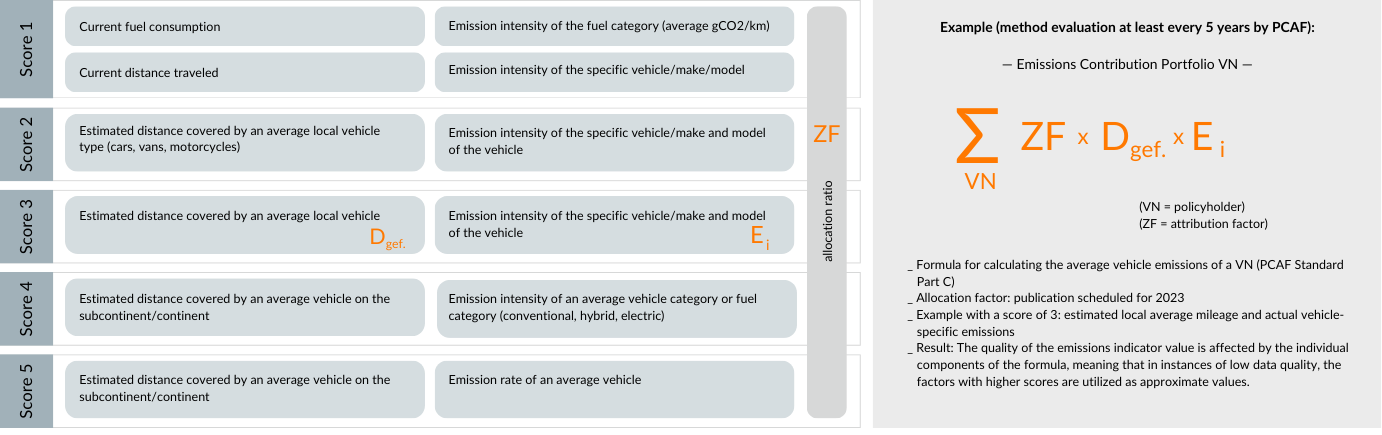

Depending on the business model of the financial service provider, the CO2 emissions of customers need to be collected differently. PCAF has taken this into account and developed three sections:

Part A "Financed Emissions"

The focus is on banks that are active in the following seven business areas: equity and debt financing in the capital market, commercial corporate financing / debt procurement outside regulated markets, project financing, commercial real estate financing, mortgage loans, car loans, or government debt / public sector financing.

Part B „Facilitated Emissions"

Primarily aimed at trading venue operators ("emissions associated with the capital markets transaction") and is scheduled to be published in 2023.

Part C „Insurance-Associated Emissions"

Aimed at (re)insurance companies, focusing on the collection of emissions associated with products from the business areas of commercial insurance (including commercial auto insurance) and private auto insurance.

The relevance of this initiative is also evident through references in regulatory consultations (e.g., EBA Consultation).

Why 4C?

In supporting decision-makers, we, like the PCAF standard-setters, pursue an end-to-end approach from analyzing existing and required information to processing, publishing, and forwarding it to internal risk management.

We place a special focus on the collaborative design of the approach model, creating a modular framework that can be adapted or expanded as necessary due to evolving parameters.

Due to the high number of parallel challenges, we see increased interest from our clients in an integrated approach and close integration of various sustainability aspects (e.g., EU Taxonomy Regulation, Net-Zero Emissions) with the overall ESG concept. The goal is to jointly avoid redundancies, discrepancies in models, and fundamentally maintain efficiency.

The integration into the corporate culture of each institution forms the foundation for successful transformation implementation. In this, we empower bold decision-makers.

Do you have any questions or would you like to find out more about our services?

Contact us for a non-binding consultation.

More Topics

Your Experts

Jobs @ 4C

Contact Us

We would like to point out that this website offers only a limited insight into our services. Our expertise and range of services cannot be fully represented on this platform. For personalized advice and to best address your specific concerns, we warmly invite you to contact us directly so we can offer you tailored solutions.

Thank you for your trust. We look forward to hearing from you.